Assessment Year 2018-2019 Chargeable Income. Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060.

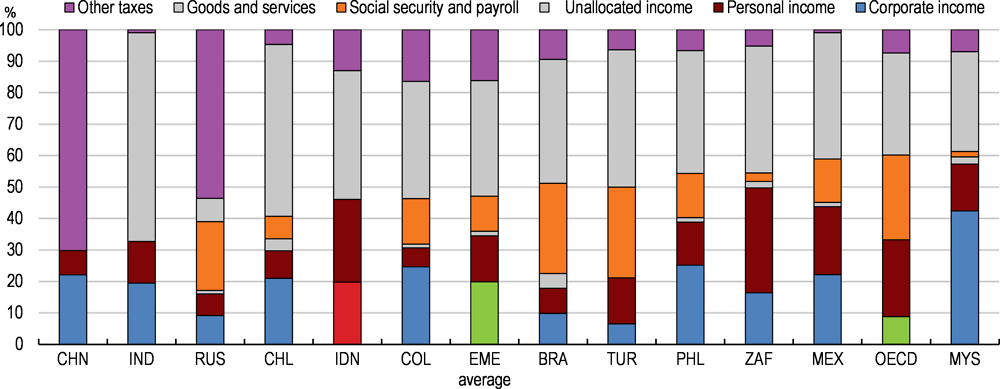

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

Income tax in Malaysia is imposed on income.

. The exemption is applicable for each property if Adam has in excess of one property in this category. Rents out his residential properties at a rate below RM 2000 a month. The rental value of the property is calculated according to the property type and location.

As unfortunate as this may sound the government has announced other tax reliefs for 2020. Applicable for Year Assessment YA 2018 to 2020. While rental income must be declared alongside other sources of income if you own real estate in Malaysia you will be subject to other property taxes as well.

This tax is known in Malaysia as cukai pintu. 2018-2020 the plan was dropped and it was only allowed for 2018 tax claims. 7 December 2017.

Her chargeable income would fall under the 35001 50000 bracket. Tax exemption on rented home rental income of 50 for rental income up to RM2000 per month to Malaysians residing in Malaysia. This means that in 2022 youll be filing your taxes for YA 2021 that ends on 31 December 2021.

Its a tax based on the rental value of a property paid by the owner. For the resident the tax rate will be. Its paid to the local authorities who set their own rate but its most often around 4 of the rental value.

For non-resident tax rate chargeable will be. On the First 5000. Calculations RM Rate TaxRM 0-2500.

This was introduced in Section 4 d of the Income Tax Act 1967 ITA. 100 US 400 MYR. Tax chargeable on the rental Income will be.

Youll only be given a few months to file your income tax so be sure to keep all your payslips EA Forms and receipts as youll need them to file your taxes. Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service charge sinking fund and management fees are deductible. As we mentioned earlier this is an offence.

The intention of this proposal is to promote. Calculations RM Rate TaxRM. For the first RM 20000 tax to pay is RM 475.

Residential homes received by resident individuals. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions. 19 December 2018 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General of Inland Revenue is empowered to make a Public Ruling in relation to the application of any provisions of the ITA.

As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia. Free shipping for many products. 50 tax exemption will be granted on rental income not exceeding RM2000 a month on.

Fourth Adam is able to claim 50 exemptions on the tax on rental income if he. We assist all clients in managing their. Income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24.

Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. 122018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. The legalese gets complicated so lets break.

For every RM 1 above will be 7 tax to pay is RM 220. Quit rent is RM50 and assessment tax is RM500 then net rental income is calculated. The criteria to qualify for this tax.

2 Exchange rate used. Because of this many landlords have failed to include their rental income when submitting their tax forms. To have commercial property to be taxable under the 6 GST the homeowner must own 2 or more commercial properties or a commercial property valued at more than RM 2 million.

Subject to certain conditions the 2018 budget would provide a 50 income tax exemption on rental income earned by Malaysian resident individuals effective from YA 2018 to. Special classes of income. So if John had made RM 150000 in statutory income inclusive of his net rental income in.

What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. These taxes are either paid one-off or on an annual basis at various times throughout the year.

It was proposed in Budget 2018 which was tabled in parliament on 27 October 2017. RM 23150 x 28 RM 6482. The RM 7300 in net rental income is subject to a tiered-rate depending on his final statutory income.

Alternatively the homeowner may own a land larger than 1 acre or earn more than RM 500000 through yields from the properties. Rental of moveable property. She would need to pay RM600 on the first RM35000 and 8 on the remaining RM4060 RM32480 which totals to RM92480.

1 The property is jointly owned by husband and wife but then taxed separately 50 upon each partner. Tax Exemption On Rental Income From Residential Houses. Tax Rate Applicable Lets say John is a tax resident in Malaysia.

The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below. Therefore the final figure of Johns net rental income is RM 7300 in 2021. The exemption would be effective for 3 years from 2018 to 2020.

Total to tax to pay. The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. Find many great new used options and get the best deals for 2018 TurboTax Premier Investments Rental Property Fed State Income Tax at the best online prices at eBay.

Property taxes can be troublesome and. The government of Malaysia is offering 50 income tax exemptions for three consecutive years 2018 2020 to individuals who rent out their residential properties at a rate not exceeding RM 2000 per month for each property. On the First 2500.

Best Places To Retire In 2022 The Annual Global Retirement Index

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

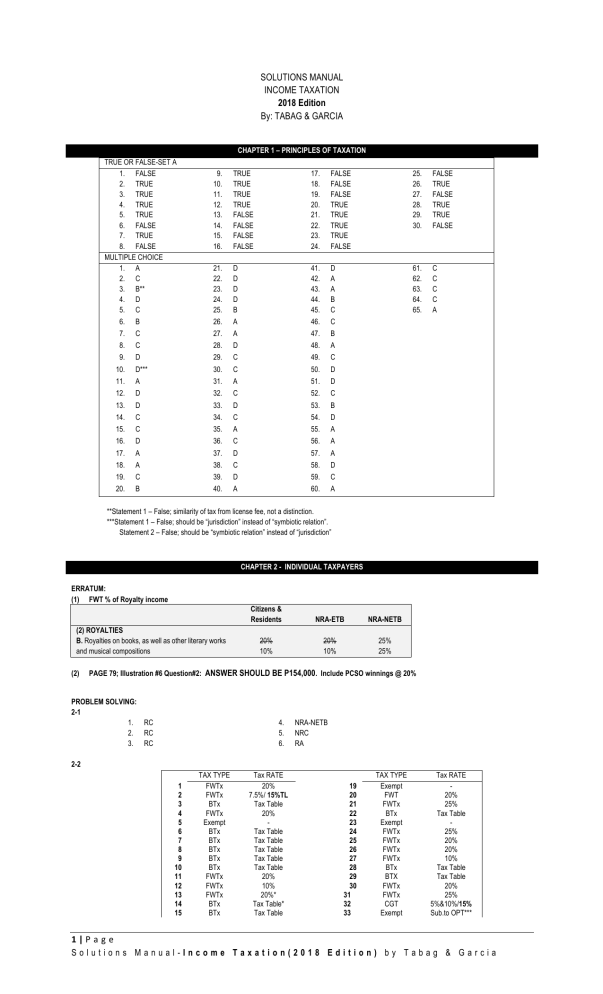

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

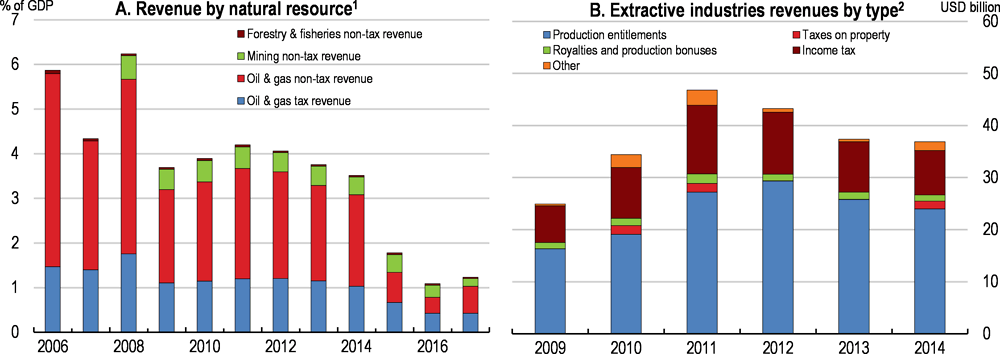

Tax Revenue Mobilization Episodes In Emerging Markets And Low Income Countries Lessons From A New Dataset In Imf Working Papers Volume 2018 Issue 234 2018

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

1 Tax Revenue Trends 1965 2019 Revenue Statistics 2020 Oecd Ilibrary

Property Tax In Malaysia Real Estate Glossary Malaysia Property Property For Sale And Rent In Kuala Lumpur Kuala Lumpur Property Navi

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

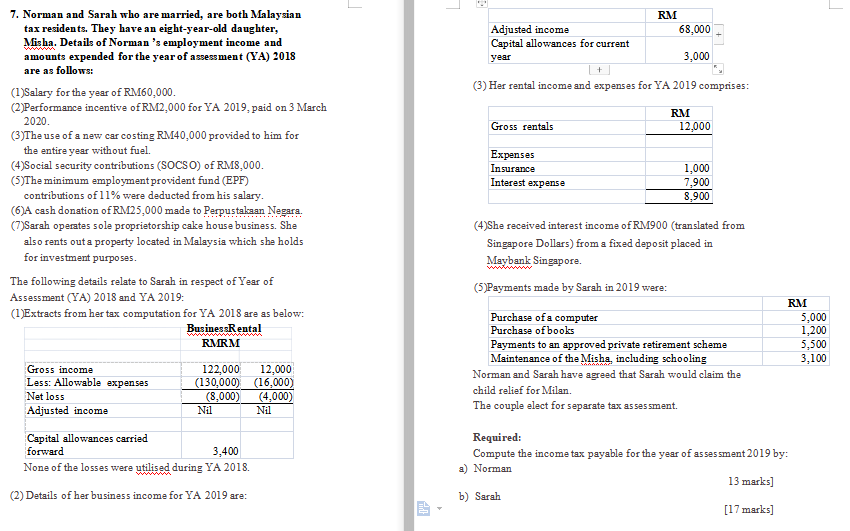

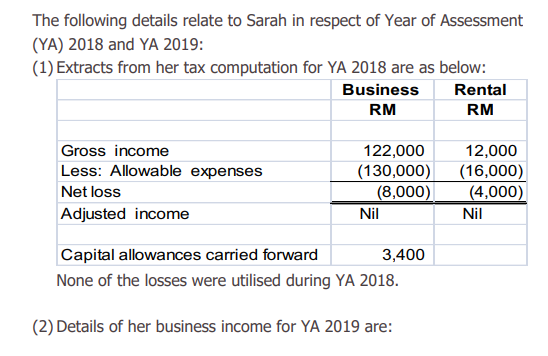

7 Norman And Sarah Who Are Married Are Both Chegg Com

Airbnb Guide To Investment Locations In Malaysia Property Investor Malaysia Investment Property

4 Dec 2018 Investing Activities Financial

How To Report Foreign Rental Income On Overseas Property

Mesa County Property Tax Assessment Grand Junction Homes For Sale Grand Junction Colorado

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Albania Technical Assistance Report Tax Policy Reform Options For The Mtrs In Imf Staff Country Reports Volume 2022 Issue 052 2022

Income Tax Malaysia 2018 Mypf My